Developing financial insights about a client is one of the key skills that separates top performing sellers from all others. Client financial insights include analyzing a client’s financial performance, identifying areas to explore further, and linking gaps in performance to your solutions. Financial insights help you communicate more effectively with executives, to show the real value of your solutions, and to distance yourself from the competition.

Part 1 of this three-part series illustrates the benefits gained from developing client financial insights and how it fits into value-based selling, which we call insight-led selling. Part 2 is case study on developing financial insights, and Part 3 will show you how to use financial insights in conversation with executives.

Benefits

The bottom line is that making client financial insights part of your sales methodology will improve your top line! For example, a global technology solution provider has made client financial insights an integral part of their sales methodology. A majority of sellers report they have:

- Accelerated sales cycle by more than 10%

- Increased deal size by more than 10%

- Developed stronger relationships with executives

- Increased personal credibility with clients

What would it be worth to your company to have a 10% bigger deal sizes and 10% shorter sales cycle?

How Financial Insights Fit

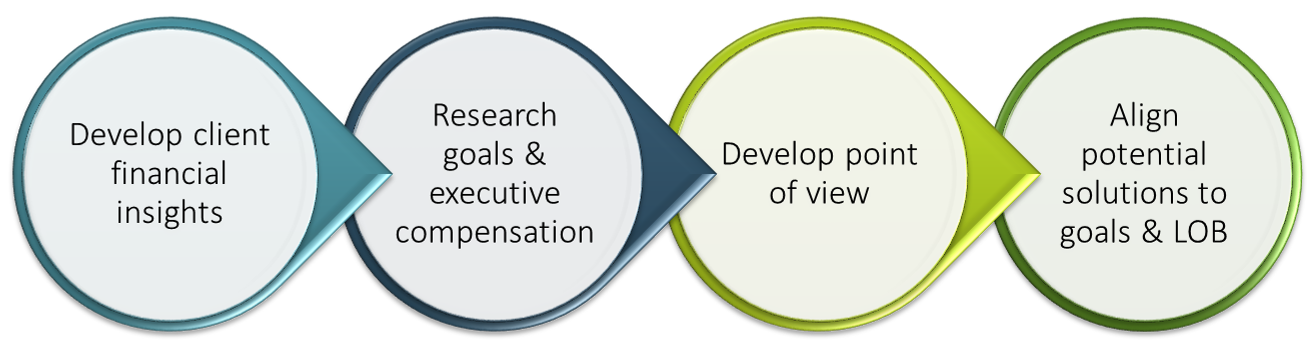

Developing financial insights is a key step in insight-led selling.

Analyzing a client’s financial performance involves more than just reviewing the numbers. The numbers tell you the what, but they don’t tell you the why. That’s why analyzing a client’s financial performance also includes digging into details behind the numbers. What is management saying about the numbers? What’s happening to operational key performance indicators (KPIs) underlying the financial metrics? How are industry trends influencing financial performance?

Do I need to be a financial expert?

For most people, the word “finance” sends shivers up their spine! It conjures up images of a bean counter or instructions on building a self-driving car – boring and overwhelming. I have been in finance for many years and I love it, but I would be delusional to think that the first thing most sellers think about is developing client financial insights. Here’s the good news: you can develop and use financial insights without being a financial expert or diluting your exuberant personality.

In each industry there are two or three areas of financial performance that executives are most focused on. You need to feel confident discussing those areas of performance from a business perspective (not how they are calculated), be able to articulate how your solutions can improve these areas, and ultimately, by how much.

Hasn’t my client already conducted this type of financial analysis?

Yes. Managing and measuring financial performance is one of an executive’s most important responsibilities. As such, it’s critical that you know a client’s financial performance to develop an executive perspective and more effectively communicate with lines of business.

Finance is the language executives use to communicate with investors. On earnings calls, they talk about revenues, profit margins, EPS, and other measures of financial performance. Internally, it’s the common language used by lines of businesses to communicate benefits and challenges. For example, Sales manages and measures items like pipeline, closure rate, and customer retention, supply chain fill rates, on-time delivery, and cost to serve. However, when collaborating on an initiative like improving Net Promoter Score they use the language of finance to communicate the impact on revenue and profit.

Is the purpose to have a financial discussion with a client executive?

No. The purpose is not to give a financial history lesson. The purpose is to have a business discussion about how your solutions deliver business outcomes. In this discussion, you include selected references to the observations from your financial insights and the improvement in the client’s financial performance from your solutions.

More to come – keep an eye out for Part 2 of this series where we’ll illustrate a case study on developing financial insights; Part 3 will show you how to use financial insights in conversation with executives.

Your takeaways:

- How do you rate your skills in developing client financial insights?

- What are the two or three financial metrics most important for your client executives?

- How do your solutions help improve these metrics?