Part 1 of this series explored the benefits of selling with financial insights and how it’s an integral part of insight-led selling. This Part 2 provides a case study on developing financial insights using a real company. Part 3 offers guidance on using financial insights in conversation with client executives.

Client Financial Insights Framework

Here’s a proven framework for developing client’s financial insights:

- Trend: How does the client’s current performance compare to previous years? What’s management saying? Is there a measurable goal? What’s happening to related operational KPIs?

- Peers: How does the client’s performance compare to its peers? What unique factors like pricing strategy and revenue mix contribute to differences? What about factors like leading or lagging in digital transformation? Is there an overall trend? How do the client’s operational KPIs compare to their peers?

- Industry: How does the client’s performance compare to industry norms?

- Gap and Power of One Analysis: What are the cash flow benefits if the client could match the financial performance of its best year? Of its best performing peer? What’s the value if the client could improve a financial metric by one percent?

Financial analysis isn’t just reviewing the financial metrics, you need to peel back the onion to have a more complete business perspective. For example, listen to a client’s earnings call – they’ll start with numbers like revenue and then dig deeper into the contributing factors.

Case Study

Your client is a brick-and-mortar apparel retailer with online sales in the low double-digits. In retail, three of the key financial metrics are revenue growth, operating income margin, and days in inventory. This example is based on a real retailer.

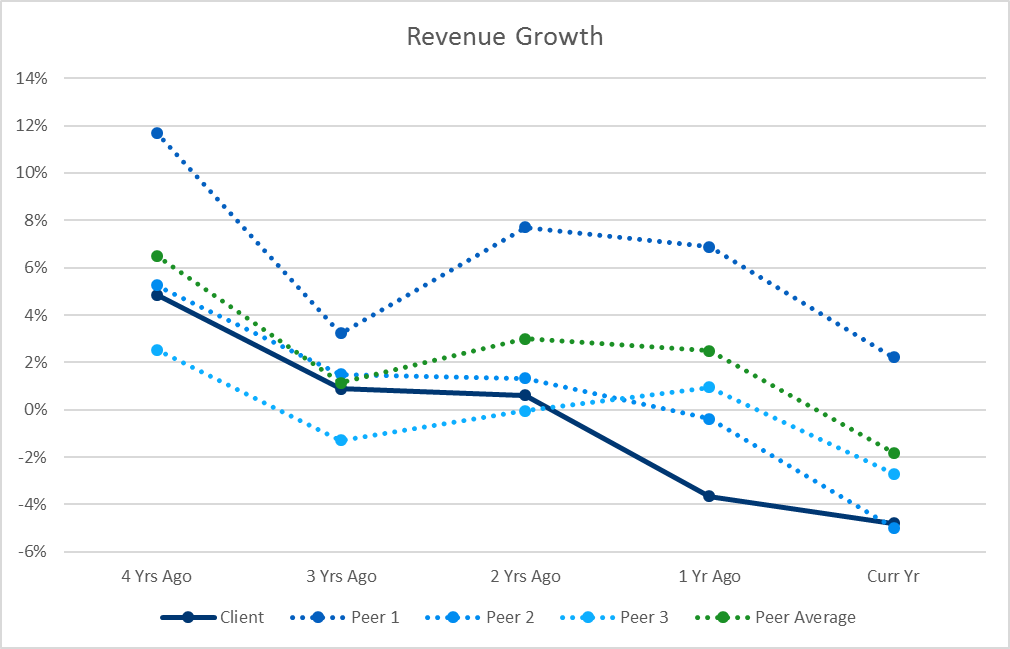

The trend analysis shows the client’s revenue growth of around -5% is the lowest it’s been in five years and the trend is not good. Comparable store sales, number of stores, and average ticket size are some of the key performance indicators (KPIs) driving the client’s revenue growth. Their annual report reveals that comparable store sales declined 3% and that there were 5% fewer stores. A bright spot is that its online sales are growing. It wouldn’t take much more time to research the trend for other KPIs and have a deeper understanding of the decline in comparable store sales.

The client is one of the lowest performers compared to the peers. All the companies are experiencing slowing growth. We all know that retail dynamics are changing. Online retailers are experiencing double-digit revenue growth (Amazon reports over 25% growth for its most recent fiscal year) and taking market share away from brick-and-mortar retailers.

Closing the Gap and Power of One

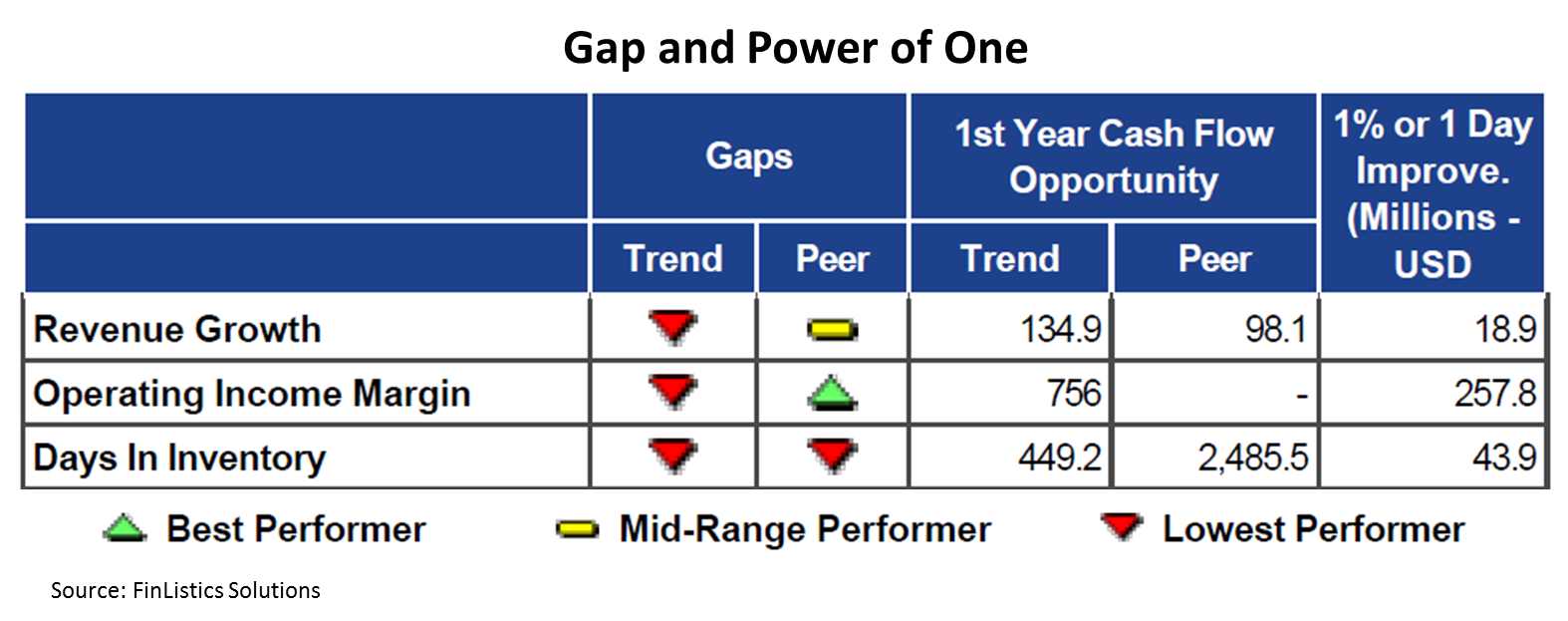

It’s also important to value the gaps in the client’s financial performance and review the Power of One, which illustrates the benefit of a one percent improvement and will show you where the greatest areas of opportunity are from a financial perspective. They also help you develop insights into where your solutions provide maximum benefits.

The data for the 1st Year Cash Flow Opportunity shows the cash flow benefit if the client could improve performance to their best performing year (Trend column) or best performing peer (Peer column). For the trend, the greatest benefit ($756M annually) comes from increasing profitability to its best year. The greatest benefit ($2,486M one-time benefit) results from reducing days in inventory to the best performing peer. The Power of One shows that a one percent improvement to the operating income margin delivers the highest cash flow ($258M annually).

More to come – keep an eye out for Part 3 of this series where we’ll show you how to use financial insights in conversation with executives.

Your takeaways:

- Conduct a financial analysis for one of your clients.

- Improvements in which financial metrics deliver the greatest cash flow benefits?

- How do your solutions help improve these metrics? How would you explain this to a client executive?