In today's rapidly evolving business landscape, supply chain leaders face the complex task of managing cash conversion terms while driving profitability and resilience. The COVID-19 pandemic emphasized the importance of cash flow and supply chain resilience, leading organizations to recognize the critical role of the financial-supply chain management connection. To explore this topic further, Dr. Stephen Timme, Founder and President FinListics Solutions, spoke on a webinar with Throughput.ai that delves into the synergies between financial and operational aspects of the supply chain and how they impact cash flow and profitability. Learn more as we discuss strategies for enhancing cash flow and leveraging data-driven decision-making to drive value creation.

The Tactical and Strategic View

Supply chain leaders at the operational and C-suite levels are multitaskers, managing various responsibilities. While functional leaders focus on granular operational data to ensure efficient supply chain processes, C-suite executives have a broader strategic perspective. They oversee brand identity, legal and risk implications, fiscal responsibility, global compliance, ESG criteria, and overall supply chain value creation. It is crucial for these two groups to come together, align their objectives, and examine the financial-supply chain connection holistically.

The Impact of COVID-19

The COVID-19 pandemic disrupted global supply chains, causing resource shortages, logistics challenges, and demand-supply uncertainties. The operational and financial sides realized the need for real-time and granular data to make informed decisions. Successful organizations seized this opportunity to bridge the gap between the C-suite and operational teams, recognizing the consequential nature of decisions that affect shareholder and customer value. They understood that supply chain value is binary—created or destroyed, but never neutral. By leveraging data and collaboration, companies adapted their operations to improve resilience, profitability, and free cash flow.

The Financial Perspective

Financial performance is closely intertwined with operational outcomes. Revenue growth, cost management, inventory optimization, and fixed asset utilization impact a company's financial health. Increasing capacity utilization, reducing direct costs through better materials usage and scheduling, optimizing inventory mix, and improving fixed asset utilization contribute to higher profitability and cash flow. By aligning operational key performance indicators (KPIs) with financial goals, organizations can effectively communicate the value of operational improvements to stakeholders.

Data-Driven Decision-Making

Organizations must leverage data and analytics to unlock the power of the financial-supply chain connection. Through data-driven decision-making, companies can optimize inventory mix, allocate resources efficiently, and rationalize product offerings. These actions enable organizations to improve working capital, prevent layoffs, streamline asset utilization, and make better-informed decisions throughout the supply chain. Businesses can significantly improve cash flow and profitability by aligning data and operations.

The Power of One

Achieving a 1% improvement across various operational and financial metrics has proven transformative for organizations. It creates a safe space for collaboration, encourages trade-offs, and enables enterprises to achieve tangible results. A 1% improvement may seem small, but it substantially impacts financial performance, especially when compounded across multiple areas of the supply chain. By embracing the power of one percent, businesses can drive positive change, achieve financial goals, and remain competitive.

As markets evolve, businesses must adapt to changes in product mix, customer demands, and industry dynamics. It is essential to evaluate how these changes impact financial performance. While delivering 100% of the desired outcomes may not always be feasible, achieving 10% or 20% of the target can create significant value for a company. By embracing incremental improvements, organizations can enhance profitability and drive growth.

Benchmarking plays a crucial role in assessing performance relative to peers. It enables companies to compare their financial and operational metrics with industry competitors. When analyzing benchmark data, it is essential to consider factors such as unique product mix, business models, and geographic considerations. However, it is vital not to overlook potential areas of improvement. If certain peers consistently perform better in specific areas, it signifies opportunities for advancement within the organization.

The Power of Data in Financial-Supply Chain Management

In pursuing enhanced profitability and cash flow, organizations must leverage data and analytics to optimize their supply chains. The availability of real-time visibility has become increasingly vital, enabling carriers, providers, and shippers to make informed decisions regarding logistics, capacity, schedules, and asset utilization. However, to achieve holistic and actionable insights, it is crucial to integrate both operational and financial data.

As a decision support tool, throughput allows organizations to make strategic decisions based on granular data. It empowers businesses to identify areas for improvement, such as optimizing inventory mix, improving throughput, and rationalizing product offerings. This newfound language of supply chain optimization allows enterprises to align the C-suite and operational teams, fostering collaboration and driving effective decision-making.

Unleashing the Potential of Enterprises and Industries

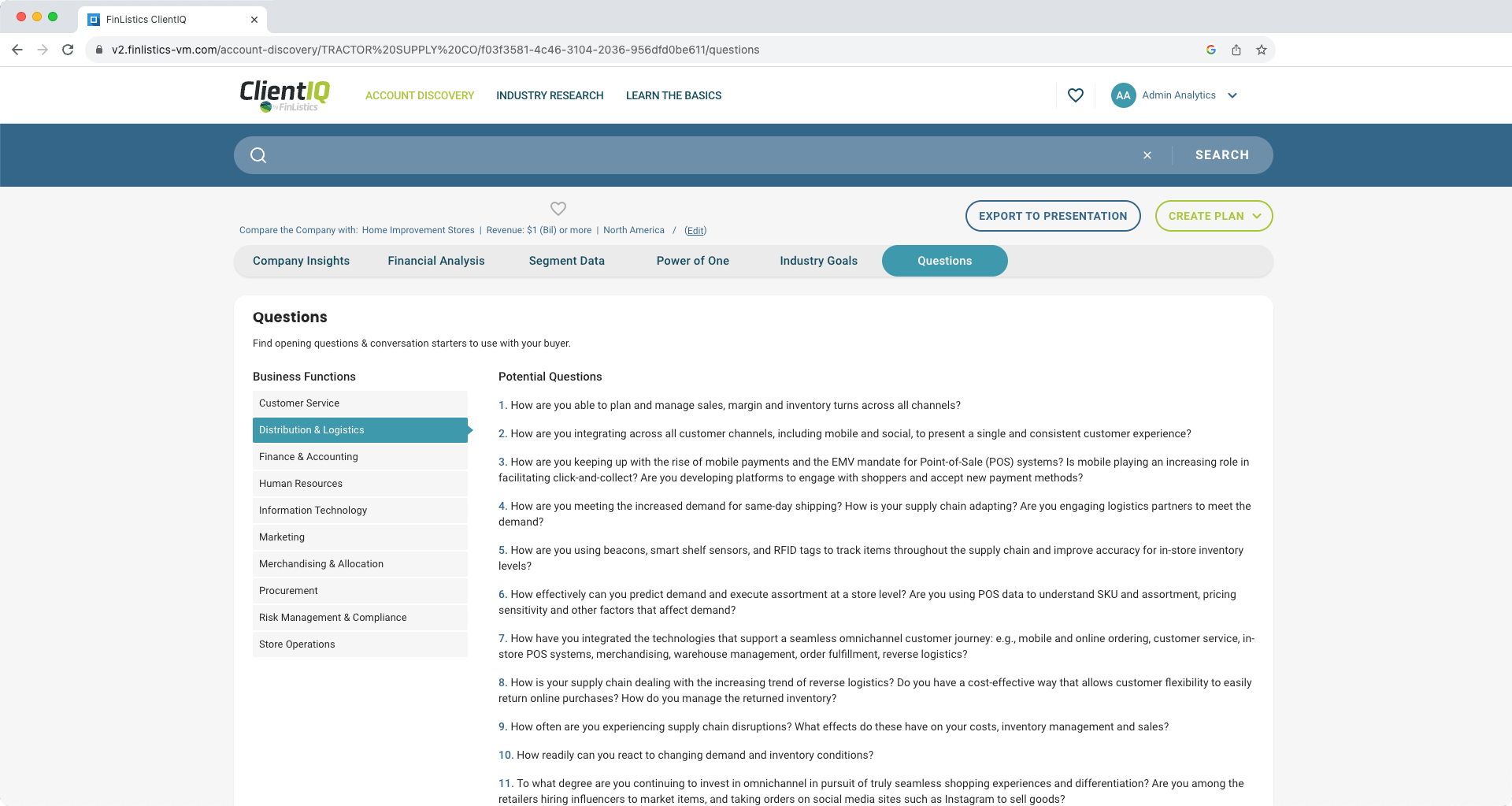

Global opportunity lies in unlocking the true potential of enterprises and industries by establishing common frameworks for decision support. Throughput.ai has rapidly emerged as a defining platform, providing real-time decision support on what to stop, start, and continue within the supply chain. Meanwhile, ClientIQ offers a language that enables strategic discussions between the C-suite and supply chain executives at a granular level, allowing for a clear understanding of how the enterprise will execute its annual operating plan. This eliminates confusion and enables precise decisions regarding capital and resource deployment, initiative prioritization, and overall organizational alignment.

Overcoming language barriers and improving decision support can revolutionize supply chain management, transforming enterprises, industries, and societal impact. Essential tasks, such as a private equity group's due diligence, a CEO's portfolio analysis, or a board's business health assessment, all require a comprehensive financial overview. By promoting effective communication and objective alignment across the organization, companies can focus on profitability and improvement. Further, empowering middle management to convey critical ideas like working capital, inventory spread, and throughput enables resource flow, meeting financial goals of shareholders and stakeholders.

The financial-supply chain management connection is critical to driving cash flow, profitability, and resilience. As markets evolve, organizations must adapt to changing dynamics and benchmark their performance against industry peers. Leveraging data, analytics, and decision support tools like Throughput.ai and ClientIQ empowers enterprises to optimize their supply chains, make informed decisions, and achieve incremental improvements in financial performance. By embracing the power of one and prioritizing collaboration, organizations can unlock their true potential, reinvent industries, and create long-term value.

Gain a deeper understanding of how the financial-supply chain connection can drive value creation and ensure long-term business success. Listen to this webinar to gain valuable insights into enhancing cash flow and driving profitability through the financial-supply chain management connection.