This blog is the first in a four-part series with our strategic partner, Revegy.

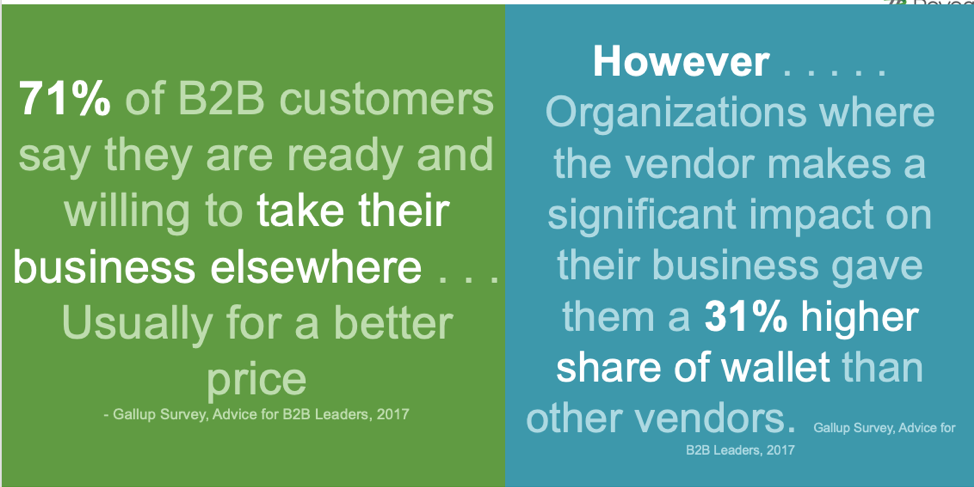

In the age of customer centricity, B2B companies are fighting for a competitive advantage through strategic relationship building. By changing the dynamics between customer and provider, companies that earn trusted advisor status see significantly more wins, close deals faster, and are less likely to get blindsided by a client’s internal turmoil.

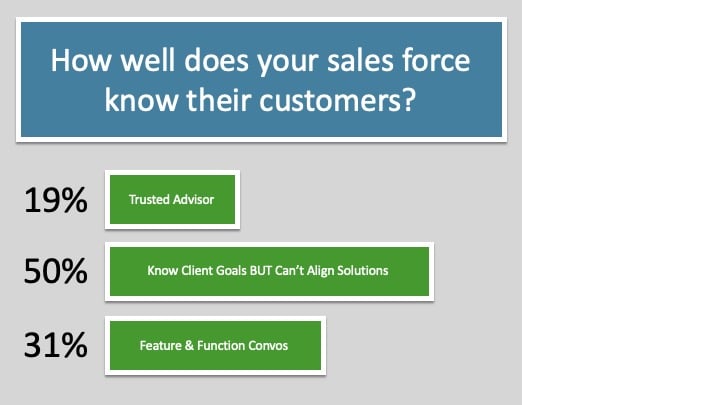

In a recent webinar conducted with Revegy, a leading technology platform for customer revenue optimization, and FinListics, the solution for financial analytics that power insight-led sales, top performing sales leaders indicated that being a trusted advisor is more elusive than most sales and account managers think.

Less than 20% of the participants polled indicated that they considered themselves a trusted advisor within their key accounts.

Worse still, over 50% of the participants were unable to align their solutions to the clients’ business goals. Approximately 30% describe their sales and relationship development practices as primarily a one-sided pitch centered around their products’ features and functions. Yikes!

In Strategic Accounts, the journey to revenue growth comes through the Trusted Advisor superhighway – and frankly the toll to get on that road is to provide business value through the eyes of your client. They don’t care about your product - how modern, how hot, how many others use it. And senior executives surely don’t care about the features and benefits. Their job is to improve the performance of their company and execute the strategies they have in place. Either they deliver or they get shown the door.

In this blog series, we’re going to take a look at building stronger client relationships through Revegy’s Customer Revenue Optimization Framework - not only how to build stronger executive relationships, but also how to find the next set of growth opportunities to pursue within your strategic account.

Part 1: Developing Customer Insights

Dr. Steven Covey, in his book ‘7 Habits of highly effective people’ advises readers to ‘seek first to understand, then to be understood.’ And that’s a big challenge for most companies.

Developing customer insights isn’t a one time thing, it should be an integrated part of an your strategic client development. Let’s look at some of the basics for this process:

- Industry Knowledge

Your customers are looking to improve and one of their favorite ways to do so is to peer deeper into what the competition is doing. Some of your clients are followers and some want to be leaders. Knowing THEIR competitive positioning is key. Companies who become trusted advisors are partners in identifying competition, understanding common industry challenges, and offering solutions that adhere to best practices. Engaging clients without an understanding of the playground on which they are playing, means that you’re wasting time ‘getting up to speed’ instead of having value-driven conversations.

If you have other customers in this industry or have sold into the industry before. Lead with your stories. “Mrs. or Mr. Customer, in working with other companies in your industry, they are very focused on XYZ problem because of market pressures – is that something important to you?”

You will get extra trusted advisor points by giving them advice on a problem WHERE YOU DON’T MAKE ANY MONEY. Advisor’s are not necessarily altruistic, but instead they have a definite bias away from themselves and toward the customer.

- Personas

You also need to take a closer look at the person/people to whom you’re talking. The c-suite is going to have a very different perspective and set of metrics than the mid-level manager, and Marketing cares about different topics than Finance. A quick google search can help you with terms (often there is a top 10 list in role specific magazines, like Strategic Finance, CFO Magazine, CMO-The Drum). Also, IBM, PwC, and others frequently do a ‘Top 10 Problems’ list for C-level execs from surveys they run.

- Understand Their Goals

Your research into company and personas will inform a third level of understanding: their goals. Building a compelling business case for evaluating your solution hinges on your ability to successfully understand the clients’ business goals and connect your solution(s) to achieving the goal(s).

Annual reports are the standard ‘go to’ for this information. Some companies travel to big banking and financial advisor conferences. For these clients or prospects, the investor relations portion of their website is a good resource for short presentations on how they are performing, their strategy, and where they are investing (e.g. if you are selling to Goldman Sachs, look at the “Goldman Sachs Presentation to Credit Suisse Financial Services Conference.”)

And if you aren’t talking to the CEO, that’s okay, you can customize that information to engage with contacts at all levels.

“I watched Lloyd Blankfein’s presentation at the Credit Suisse conference and he’s talking about how you are improving client engagement through apps, machine learning and big data analytics. Can you share how that applies to your departmental goals?”

Those are the ‘table stakes’ to play in strategic accounts. The next step are to find the best areas to grow and build a plan to validate and execute that growth over time.

- Find Your Growth Opportunities

A strategic advisor comes to the table armed with a unique, targeted point of view. The next big deal to a strategic account doesn’t happen in isolation. Shatter your internal silos by bringing your sales, marketing, services, and product management teams to the table. Collaboration can produce a solution targeted specifically to the industry challenges, personas, and organizational goals. This is the tangible outcome of well-developed customer insights.

Now, when you approach your coach or sponsor in your target customer or strategic account you are armed with not only business insights (so that you can have a compelling conversation), but also ideas on how to help your customer succeed.

If you have 3 to 5 of these ideas, and can couch the messaging in terms of how it will SPECIFICALLY help them succeed; you can often get transparent answers. Now your clients can respond with specifics like, “we feel we have handled issues 1 and 3. Item 2 isn’t a priority until next year, but let’s talk about 4 and 5.” This is the first win.

In our next installation of the blog series, we will dive into the challenge of communicating these targeted offerings to clients through value-focused messaging. Get the most up-to-date account management news by following us on LinkedIn: FinListics and Revegy.