COVID-19 is having a significant impact on many banks’ financial performance. Provisions for credit losses are rising, loan demand is down, and net interest margins are being squeezed. Now more than ever it is important that you understand your Banking clients’ performance, as well as their goals and strategies.

FinListics’ KPIs for Sales Success for Banking provides a framework and industry information to help you better understand your Banking clients. It contains snapshots of facts and figures that you can use to quickly understand the most important metrics of your client’s business.

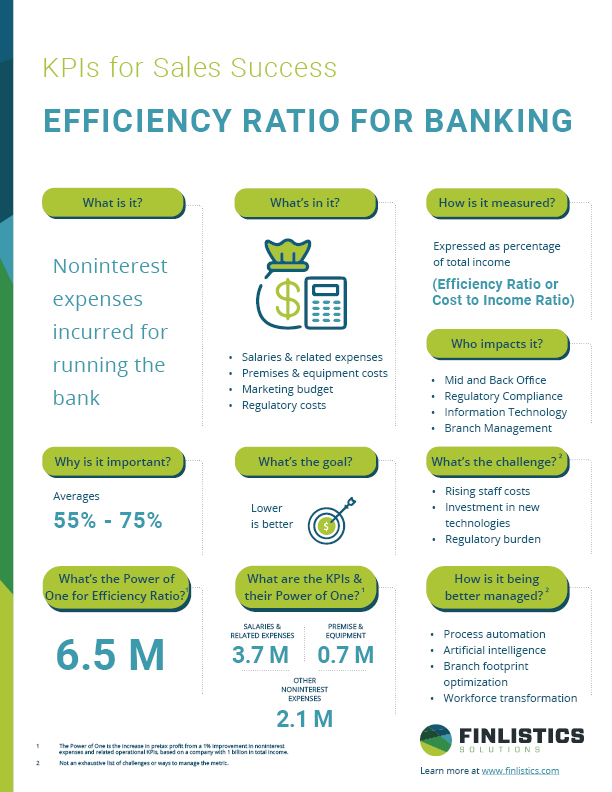

The Cost-to-Income Ratio (CIR), also known as the Efficiency Ratio, is explored in this snapshot. It includes the non-interest expenses of salaries and benefits, premises and equipment, and other non-interest expenses such as regulatory, telecommunications, exchange and clearance fees. The Cost-to-Income ratio is important since these expenses absorb on average 60% or more of revenues and is a key responsibility of business functions like I/T, marketing, operations, compliance, risk management and many more. Better managing the CIR has always been a top priority. It is even more important during these uncertain times.

Can’t wait for future snapshots? Just like your favorite Netflix series, you can binge read all Banking snapshots and other content by downloading Banking KPIs for Sales Success eBook. KPIs for Sales Success eBooks are also available for:

As you review this snapshot, answer the following questions.

- How does your client’s CIR compare to the industry?

- What impact is COVID-19 having on CIR and what impact will it have on investing in new solutions?

- How do your solutions help your client better manage CIR?

- Which operational CIR KPIs do your solutions help the client better manage?

- For those KPIs, what’s the benefit of a one percent improvement?

For more information, contact us at www.finlistics.com or info@finlistics.com