CFOs are playing an increasingly important role in formulating a company’s strategies and goals. Gone are the days of their responsibilities being primarily relegated to traditional finance and accounting functions like recording and reporting. Today they are an integral part of defining and assessing a company’s digital transformation strategy and collaborating with lines of business (LOB) to align their initiatives with this strategy. It’s for these reasons that you must feel confident talking with CFOs about the business and financial benefits of your solutions.

CFOs are playing an increasingly important role in formulating a company’s strategies and goals. Gone are the days of their responsibilities being primarily relegated to traditional finance and accounting functions like recording and reporting. Today they are an integral part of defining and assessing a company’s digital transformation strategy and collaborating with lines of business (LOB) to align their initiatives with this strategy. It’s for these reasons that you must feel confident talking with CFOs about the business and financial benefits of your solutions.

Responsibilities

One of a CFO’s and other financial executive’s most important responsibilities is working with other executives to manage a company’s financial viability. What is financial viability? Simply put, it’s a company’s ability to provide a competitive return to investors by not only maintaining but growing the business in ever-changing markets. This applies to both publicly traded and privately held companies.

So how do CFOs help manage financial viability? From an organizational perspective, it includes:

- Maintaining a company-wide view of the of the company’s business performance

- Working with the board of directors and the executive committee to formulate company-wide strategies and goals

- Collaborating with LOB executives to develop strategies and initiatives that support enterprise-wide initiatives

Financial viability from an operational perspective includes:

- Providing guidance on the impact of strategies and goals on overall short and long-term financial performance

- Optimizing overall financial performance which often includes trade-offs between the individual areas of performance

- Assisting in the assessment of individual lines of business’ investment alignment with goals and strategies, financial benefits, and risk

It’s because of financial executives’ role in managing financial viability that it’s important that you know how to communicate how your solutions enhance financial viability and by how much.

Priorities

Figure 1 shows financial executives’ top priorities for a sample of industries. There are some common themes across the industries. One, not surprisingly, is to grow the business. Some of these industries are doing more of the same, whereas others are leveraging new revenue streams. A second common theme is to expand profit margins. Regardless of whether the priority is to grow or to improve profitability, technology is a key enabler.

Figure 1

Financial Executives’ Top Priorities

| BANKING | RETAIL |

|

|

| MANUFACTURING | TELECOM |

|

|

Metrics That Matter

All CFOs focus on high-level financial metrics such as Earnings Per Share (EPS) and return measures like Return On Capital (ROC). But within each industry there are a handful of financial metrics related to operations that are focused on by CFOs.

Figure 2 shows these for a sample of industries.

Figure 2

Metrics That Matter

| BANKING | RETAIL |

|

|

| MANUFACTURING | TELECOM |

|

|

To communicate more effectively, it’s important that you know which metrics matter to your client’s CFO.

This includes:

- Knowing which business processes, activities, and operational KPIs are related to each financial metric.

- Articulating how your solutions improve the financial metrics in business terms.

- Showing by how much – in cash flow – your solutions improve the metrics via improvement in the related operational KPIs.

I want to emphasize the importance and the sequencing of the “how” and the “how much.” My experience is that a lot of sellers believe that because the CFO is a numbers person they should quickly get to the “how much.” I strongly recommend against this. Sure, the numbers are important but just as important is the “how.”

How your solutions enhance a client’s financial performance is by enabling the improved management of the related business processes and those processes’ associated activities. The success of your solutions in helping enhance financial performance is measured by the improvement in the related operational KPIs.

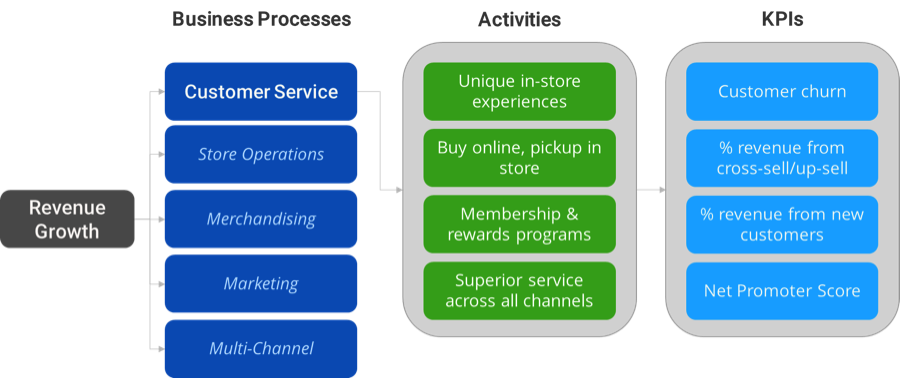

Figure 3 provides an example for a retailer whose goal is to improve revenue growth.

The retailer’s goal is to increase revenue. Some of the supporting business processes include customer service, store operations, merchandising, omni-channel, and marketing.

You’ve proposed a solution that will help better manage customer service by enhancing activities such as providing a unique in-store experience and superior service across all channels. The success of your solution is measured by improvement in operational KPIs including customer churn, cross-sell/upsell, and new customers.

Figure 3

Metrics That Matter

Call to Action

What are financial metrics focused on by your client’s CFO? How can they be improved by your solutions? Which business processes and activities are better managed? Which operational KPIs will be improved? What are the cash flow benefits from improvement in these KPIs?

Good luck.